- Hinz Sight

- Posts

- Volume 110: $999M DOT IDIQ; SLED Strategies for Administration Turnover

Volume 110: $999M DOT IDIQ; SLED Strategies for Administration Turnover

Opportunity Spotlight of the Week: $999M DOT IDIQ

Four To Follow: Four Interesting Pursuits

Capture Corner: SLED Strategies for Administration Turnover

Pricing Insights: Snapshot: Pricing vs. Program Control

Opportunity Alert – $999M DOT IDIQ

Contact Katie: [email protected]

Department of Transportation (DOT), Enterprise Information Technology Shared Services 2.

The DOT requires a contractor to provide infrastructure management, cybersecurity, application development, help desk support, and program oversight. This $999M IDIQ will be competed as both Small Business Set-Aside and Full and Open/Unrestricted. The final RFP is expected to be released around February 2026, with a projected award timeframe of September 2026. Reach out to Hinz Consulting for any Competitive Analysis, Graphics, Price-to-Win, or Proposal support, and continue to monitor SAM.gov for any updates in the procurement timeline.

Four to Follow

Department of Veterans Affairs (VA), Enterprise Resource Planning (ERP). On January 16, 2026, the Contracting Office released an RFI seeking contractors capable of providing a next-generation ERP solution that meets or exceeds industry standards for federal environments. Responses are due no later than 4:00 PM ET on January 27, 2026. The final RFP is expected around April 2026, with a projected award in September 2026. The competition type and contract value are currently unknown. Continue to monitor SAM.gov for any changes to the procurement timeline.

Department of Justice (DOJ), Federal Bureau of Investigation (FBI), Multi-Purpose Range Complex (MPRC). On January 16, 2026, the FBI released a presolicitation notice to inform industry of the procurement schedule. The final solicitation for this $100M Full and Open/Unrestricted requirement is tentatively scheduled for release on January 29, 2026. A site visit is tentatively scheduled for February 12, 2026, with registration due at least ten (10) days before the visit. Awards are projected for September 2026. Continue to monitor SAM.gov for updates and any changes to the timeline.

Department of Commerce (DOC), National Oceanic and Atmospheric Administration (NOAA), US Coast Guard (USCG) Recapitalization Project Design-Build. NOAA requires a complete Design-Build replacement of marine and shoreline structures, utilities, and support systems at the USCG Base Juneau. This $200M Full and Open/Unrestricted effort is estimated to be released on or around April 2026, with a project award timeframe in September 2026. Continue to monitor SAM.gov for further updates on this effort.

National Geospatial-Intelligence Agency (NGA), Common Operations Release Environment (CORE). NGA seeks a contractor with cost-effective modernization solutions, software engineering and architecture expertise, and deployable capabilities to expand NGA’s DEVSECOPS environment. On January 16, 2026, the Contracting Office released a modification to the RFI and extended the response date. Questions are due no later than January 30, 2026. Final Responses are due no later than 5:00 PM ET on February 20, 2026. Final RFPs are anticipated for release via the classified ARC around May 2026, with a projected award in November 2026. Continue to monitor SAM.gov and the classified ARC for further information or updates to the procurement timeline.

SLED Strategies for Administration Turnover

Contact John: [email protected]

In the State, Local, and Education (SLED) market, an administration turnover, such as a new governor taking office or a change in mayoral leadership, is often more disruptive than at the federal level. This is because SLED agencies are more decentralized so changes in leadership have more impact. Political shifts can instantly stall or redirect active Capture efforts.

The impact typically falls into four primary categories:

1. The "Pause and Pivot" in Procurement

When a new administration takes office, it often implements an immediate spending freeze or a review of significant contracts.

Pipeline Stalls: Projects in the Capture phase may be paused for several months, or even up to a year, as new leadership reviews existing budgets.

Priority Realignment: A project that was a "must-have" for the previous administration (e.g., a specific green energy initiative) may be defunded or deprioritized in favor of the new leader's platform (e.g., public safety or infrastructure).

Re-evaluating RFPs: You may see "Cancel and Re-issue" notices when the scope of an upcoming RFP is revised to align with the new administration's policy goals.

2. Loss of "Political Capital" and Relationships

SLED Captures rely heavily on deep relationships with agency leaders and political appointees.

Decision-Maker Turnover: Your "Champion" within an agency might be replaced by a new appointee who has their own preferred vendors or a different philosophy on outsourcing.

Knowledge Gaps: New appointees often lack the historical context for why a project was pursued. You essentially have to "re-sell" the problem before you can sell your solution.

3. Personnel and Operational Friction

Knowledge Drain: Career civil servants (non-appointees) often leave during transitions due to uncertainty. This leaves agencies short-staffed, leading to slower RFP responses and delayed award decisions.

Shift in Evaluation Criteria: New leadership may emphasize different evaluation factors, such as "Social Equity," "Local Preference," or "Cost Savings," requiring you to rewrite your Capture strategy late in the game.

4. Strategic Timing of the "Contracting Spike"

Administrations often follow a predictable rhythm during a turnover.

Procurement Surge: Outgoing administrations may rush to sign contracts in their final months to "lock in" their legacy. This creates a high-intensity Capture window.

The First 100 Days: In the first few months of a new administration, focus shifts to "Quick Wins." Capture efforts that deliver immediate, visible results for the new leader are more likely to survive the transition.

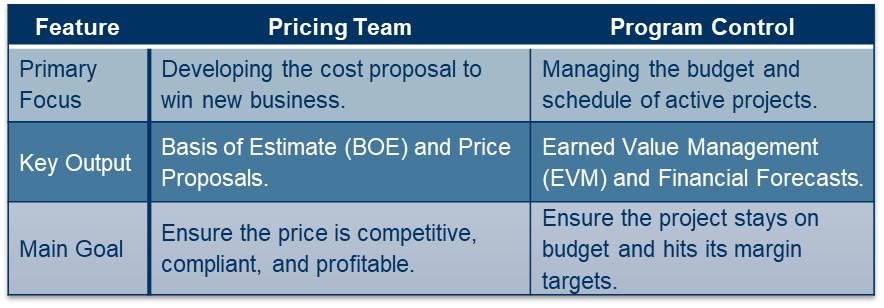

Snapshot: Pricing vs. Program Control

Contact Dr. Tom: [email protected]

In the world of government contracting and large-scale project management, the Pricing Team and the Program Control Team are two sides of the same financial coin. While Pricing focuses on winning the work, Program Control focuses on executing it profitably.

Their collaboration forms a continuous feedback loop that spans the entire contract lifecycle.

1. The Core Relationship: Pre-Award vs. Post-Award

To understand how they work together, it helps to see where their responsibilities fall along the timeline of a contract.

2. Key Touchpoints of Collaboration

A. Developing the "Basis of Estimate"

During the proposal, the Pricing Team needs to know the actual costs of the work. They don't guess; they consult Program Control for historical data from similar past projects.

The Hand-off: Program Control provides "actuals" (what it cost to build X last time) so Pricing can build a realistic bid.

The Reality Check: Program Control reviews the Pricing Team’s models to ensure the proposed labor categories and hours are executable given current workforce availability.

B. The Post-Award Kickoff (The "Handover")

Once a contract is won, the Pricing Team hands the "Winning Price" over to Program Control. This is a critical moment.

Establishing the Baseline: Program Control converts the pricing model into a Performance Measurement Baseline (PMB).

Identifying Risks: The Pricing Team briefs the Program Control Team on any "tight" margins or specific assumptions made during negotiations (e.g., "We assumed we could use junior labor for 20% of the tasks to lower the price").

C. Change Management & Requests for Equitable Adjustment (REA)

Projects rarely go exactly as planned. When a customer changes the scope, the two teams must collaborate:

Program Control identifies that the current work exceeds the original budget.

Pricing steps back in to price the "Change Order" or "New Scope."

The teams work together to ensure the new price covers the actual cost overruns tracked by Program Control.

3. The Feedback Loop

The most successful companies treat these teams as a continuous loop rather than two separate silos.

Pricing sets the target (The Bid).

Program Control tracks performance (The Execution).

Variance Analysis: If Program Control observes that labor costs are 10% higher than Pricing estimated, they report this back.

Adjustment: The Pricing Team uses this data to adjust its bidding strategy for the next proposal, so the company doesn't repeat the same underpricing mistake.

How the Pricing and Program Control Teams interact with data:

In modern firms, both teams typically share a Project ERP (Enterprise Resource Planning) system:

Pricing uses the system to look up historical indirect rates (fringe, overhead, G&A).

Program Control uses the system to compare "Budgeted Cost of Work Scheduled" (from the Pricing bid) with "Actual Cost of Work Performed."

January 26-28th: National Small Business Conference in Nashville, TN

February 1-4th: National Conference of Regions in Washington DC

February 2-5th: Rocky Mountain Cyberspace Symposium in Colorado Springs

February 10-12th: AFCEA WEST 2026 in San Diego, CA

February 12th: MPRC Site Visit in Redstone Arsenal, AL

March 12th: AFCEA NOVA Naval IT Day 2026 in Chantilly, VA

March 18th: Navy Information Warfare Industry Day 2026 in Springfield, VA

March 16-17th: 2026 Air Force Contracting Summit in Reston, VA

March 24-26th: Cyber Workforce Summit in Washington DC

About Hinz Consulting

Hinz Consulting provides services across the full business development cycle:

Proposals

Capture

Price To Win

Competitive Intelligence

Strategic Pricing

Production

AI Services

Training

BD Transformation

Process/Methodology

Tools and Template

Small Business